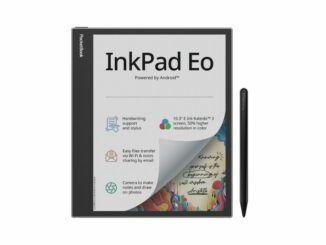

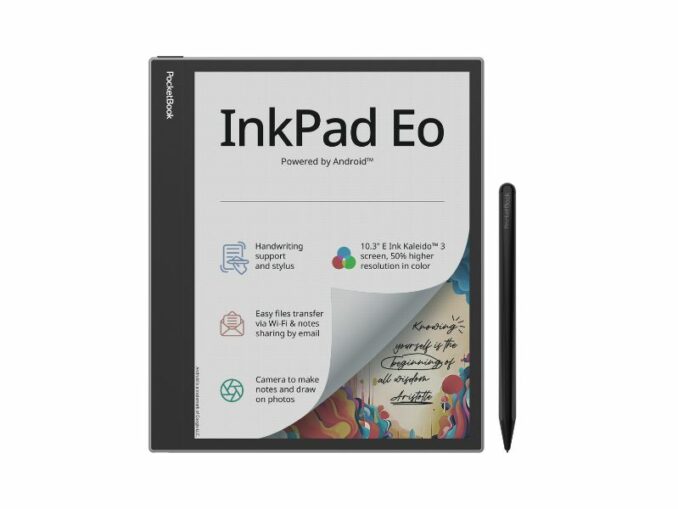

PocketBook InkPad Eo: Leistungsstarkes 10,3-Zoll-E-Note-Gerät mit Farbbildschirm

PocketBook InkPad Eo: Leistungsstarkes 10,3-Zoll-E-Note-Gerät mit Farbbildschirm In einer bahnbrechenden Entwicklung für die Welt der digitalen Lesegeräte und Notizbücher hat PocketBook das InkPad Eo vorgestellt, ein hochmoderner E-Reader und E-Note-Gerät, das mit Android 11 läuft. [Hier geht es weiter]